The Partnership sends updates for the most important economic indicators each month. If you would like to opt-in to receive these updates, please click here.

Estimated Read Time: 1 minute

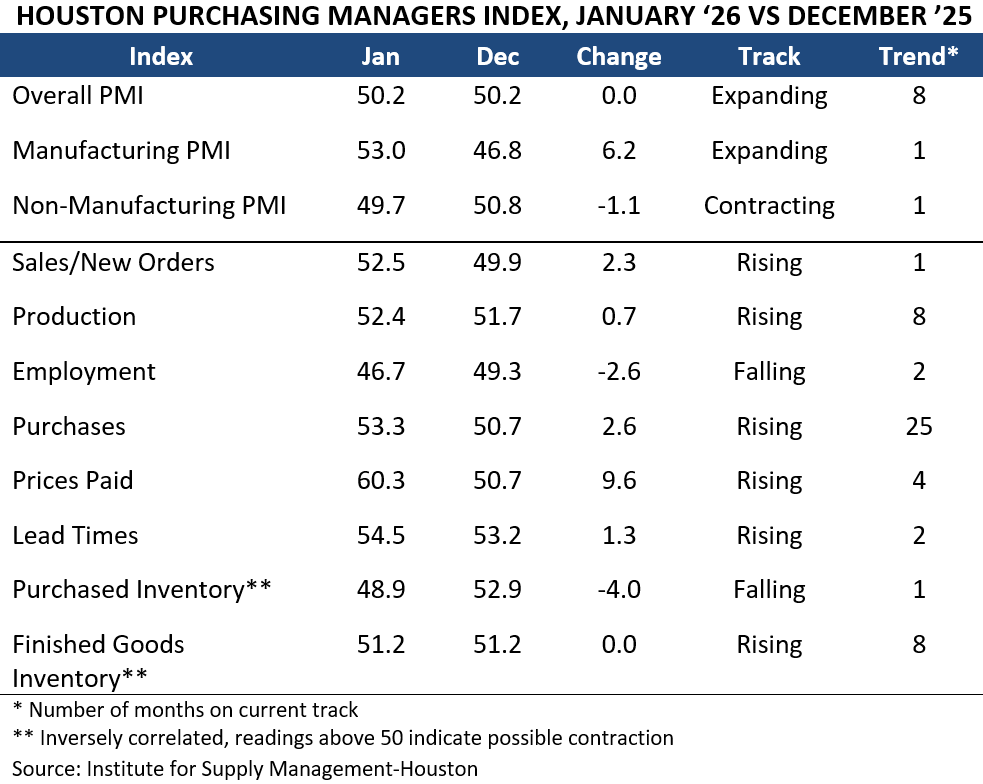

Houston’s economy continued to expand at a moderate pace in January, according to the latest Houston Purchasing Managers Index (PMI) from the Institute for Supply Management–Houston. The headline PMI, which gauges overall economic activity based on a survey of supply chain executives, held steady at 50.2 from December to January, extending the region’s expansion streak to 68 consecutive months. Manufacturing returned to growth for the first time since July, while non-manufacturing eased from modest expansion into modest contraction.

Two of the three PMI components most closely tied to Houston’s growth pointed to moderate economic strength:

• Sales/New Orders shifted from flat at 49.9 in December to expansion at 52.5 in January.

• Lead Times rose from 53.2 in December to 54.5 in January, indicating that growth in that measure is accelerating.

• Employment, on the other hand, fell from 49.3 in December to 46.7 in January, which suggests faster contraction.

On an industry-specific basis:

• Health care, construction, professional services, and durable goods manufacturing reported strong expansion.

• Non-durable goods manufacturing reported moderate expansion.

• Trade, transportation and warehousing and oil and gas extraction reported contraction.

The PMI is published monthly by the Institute for Supply Management – Houston and is based on a survey of supply chain executives in the region. For additional information, click here.

Prepared by Greater Houston Partnership Research

Colin Baker

Manager of Economic Research

Greater Houston Partnership

[email protected]

Clara Richardson

Analyst, Research

Greater Houston Partnership

[email protected]