The Partnership sends updates for the most important economic indicators each month. If you would like to opt-in to receive these updates, please click here.

Estimated Reading Time: 2 minutes

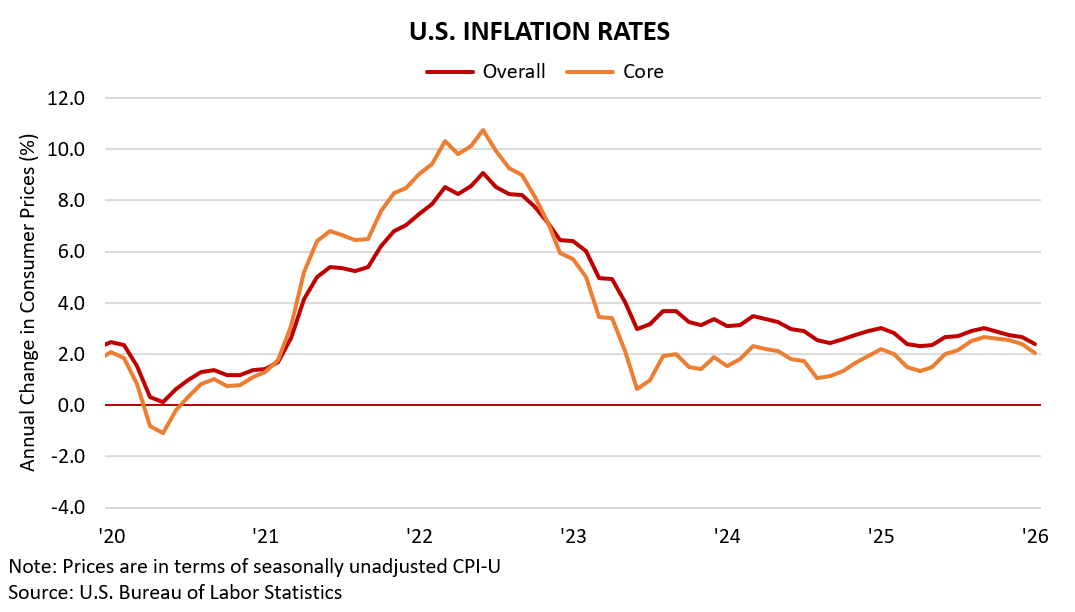

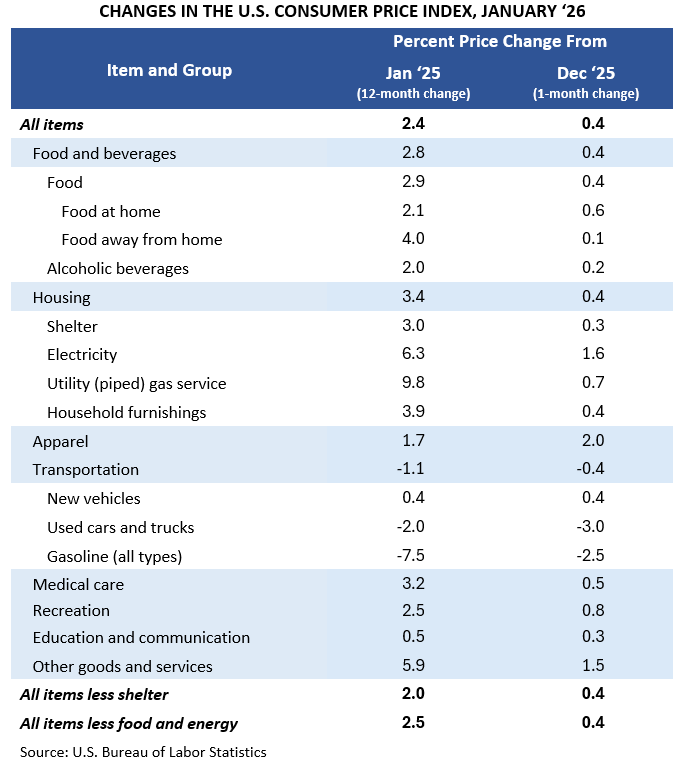

U.S. inflation cooled in January, driven in part by notable declines in the price of gasoline and used vehicles. Overall consumer prices, as measured by the Consumer Price Index for All Urban Consumers (CPI-U), rose 2.4 percent year-over-year in January, down from the 2.7 percent recorded in December. Core inflation, which excludes the volatile food and energy categories, declined to 2.0 percent from the previous month’s 2.4 percent.

Overall and core inflation (at 2.4 percent and 2.0 percent, respectively) both came in below the 2.5 percent predicted by economists in a recent Wall Street Journal survey. The cooler-than-expected reading follows on the heels of a strong national jobs report. Even so, the improvements probably are not large or sustained enough to push the Federal Reserve off its current wait-and-see stance on interest rates.

On a year-over-year basis, gasoline prices are down 7.5 percent and used vehicle prices have fallen 2.0 percent, helping drive the recent easing. Home energy costs, however, remain a headwind with utility gas up 9.8 percent and electricity up 6.3 percent compared to January ‘25, offsetting improvements elsewhere. Prices also rose three percent or more in food away from home (i.e., meals at restaurants), household furnishings, shelter, and medical care. Increases were more modest (under three percent) in recreation, food at home (i.e., groceries), alcoholic beverages, apparel, education services, and new vehicles.

Inflation data for February will be published by the Bureau of Labor Statistics on Wednesday, March 11.

Colin Baker

Manager of Economic Research

[email protected]

Clara Richardson

Research Analyst

[email protected]