The Partnership sends updates for the most important economic indicators each month. If you would like to opt-in to receive these updates, please click here.

Estimated Reading Time: 3 minutes

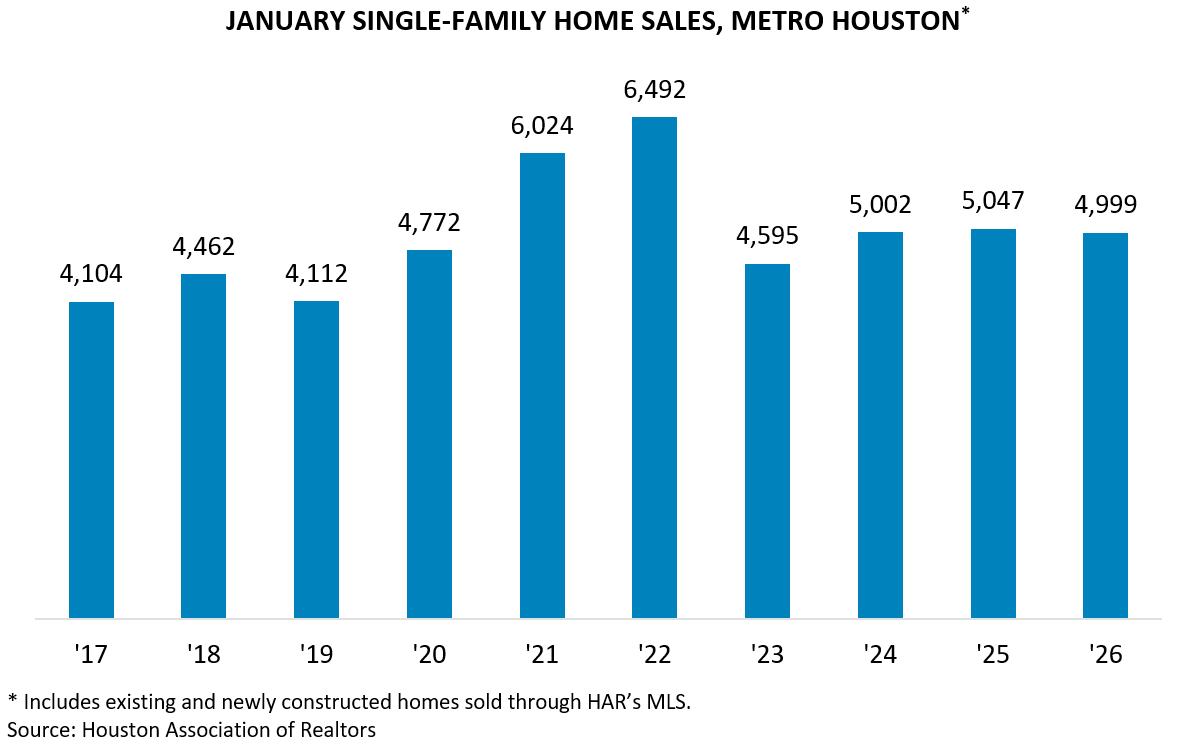

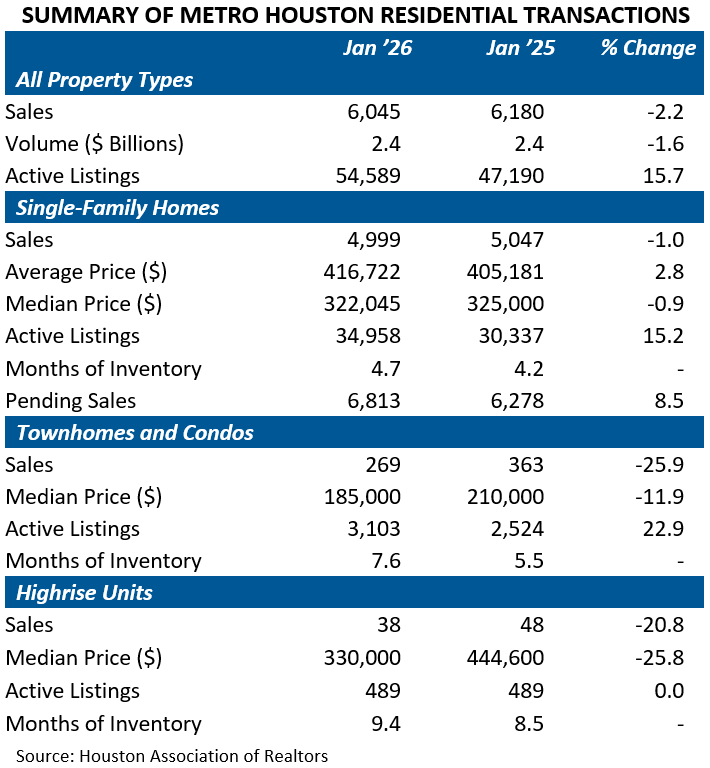

Brokers closed on 4,999 single-family homes in January ’26, according to the Houston Association of Realtors (HAR). That represents a minor 1.0 percent dip from January ’25, leaving sales in line with the pace of the past two years and still well above pre-pandemic norms. Sales of all property types declined by 2.2 percent over the same period due to softer demand for townhomes, condos, and highrise units.

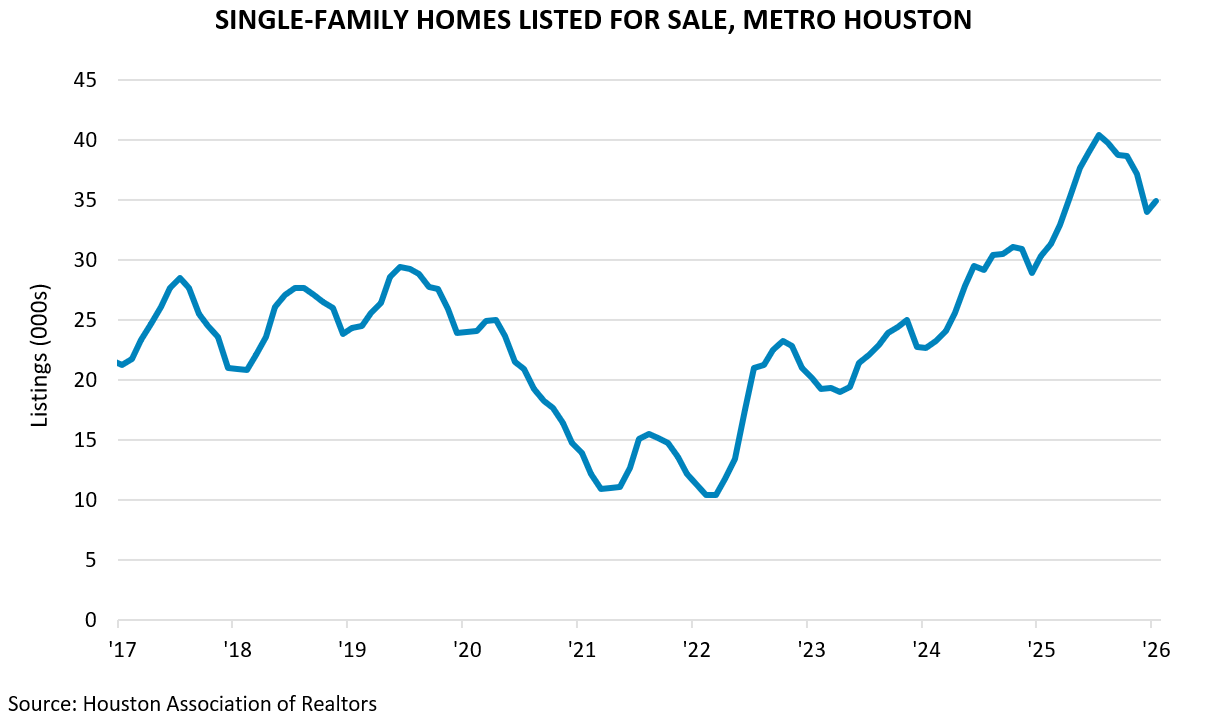

Active listings of single-family homes on the market edged up from roughly 34,000 in December to 35,000 in January. This reflects a typical seasonal bounce back from the lows of December, as many potential home sellers held off on listing their property until the end of the holiday season. Even with the increase, listings remained meaningfully below last July’s record of 40,000. If single-family homes were to continue selling at the current rate, it would take 4.7 months to sell the available inventory of homes on the market.

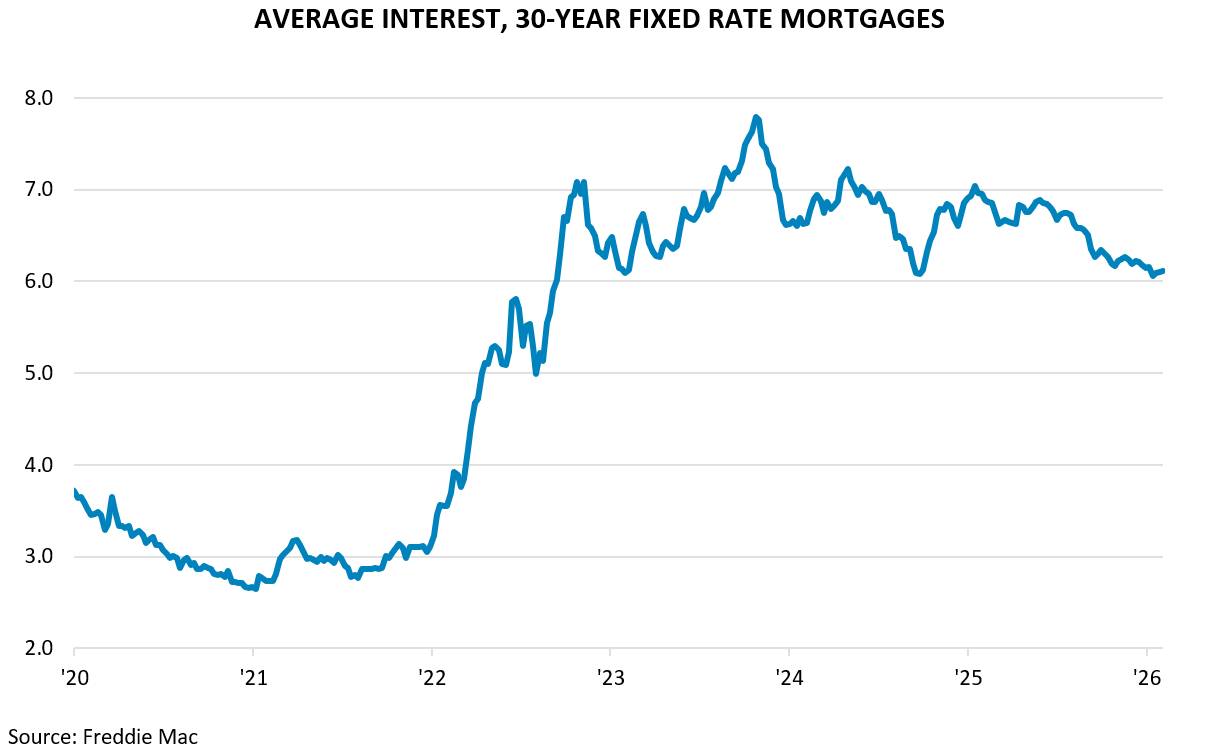

Mortgage rates were essentially flat in January and February, with the average rate on a 30-year fixed mortgage holding steady at 6.2 percent. That’s a meaningful improvement from the 7.0 percent recorded in January ’25, with potential buyers encountering a lower cost of borrowing.

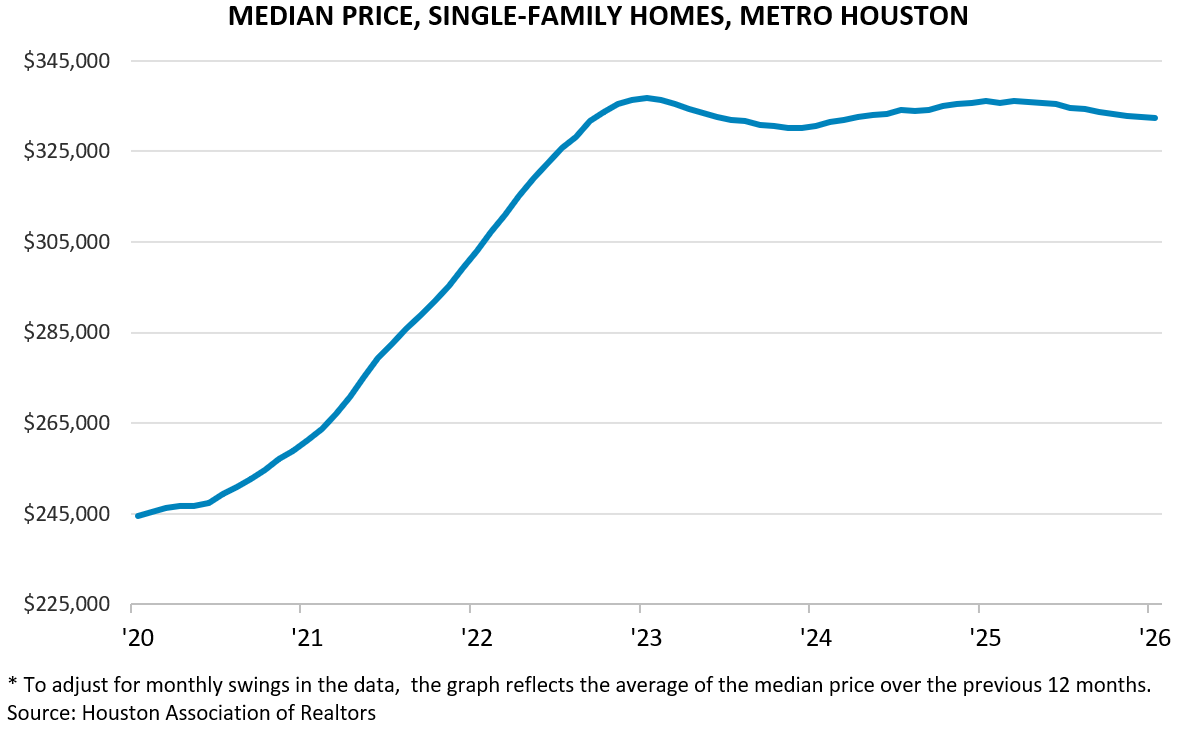

Prices for single-family homes sold through HAR’s MLS have continued to modestly decline. The 12-month average price for the median home stood at roughly $332,000 in January ’26, down from $336,000 last summer. Local home prices are now at their lowest level since March ’24, though they remain substantially elevated relative to the start of the COVID-19 pandemic.

Townhome and condo demand cooled between January ’25 and January ’26, with sales down 25.9 percent and the median price down 11.9 percent as supply was increasing. Highrise demand also softened over the same period, with sales falling 20.8 percent and median prices dropping 25.8 percent, even as supply held steady.

Prepared by Greater Houston Partnership Research

Colin Baker

Manager of Economic Research

Greater Houston Partnership

[email protected]