Experts Lend Advice on PPP Funding and Preparing Employees to Return to the Workplace

Published May 08, 2020 by Julia McGowen

Since the initial funding of the Paycheck Protection Program was made available through the Coronavirus Aid, Relief, and Economic Security (CARES) Act, millions of businesses across the country have scrambled to apply for the loans that would provide much-needed funds to maintain payroll-related expenses and stay afloat during the COVID-19 pandemic.

With funds now in the hands of business owners, and as operations begin to gradually open across Texas, many are faced with questions about the legal, tax and human resource implications that come along with the use of funds and returning employees to the workplace.

Legal, tax and human resource experts joined the Partnership’s COVID-19 Business Forum series to discuss how businesses can navigate loan compliance and HR/safety considerations for returning to work. Below are key takeaways from their discussion.

Neal Newman, Professor of Law, Texas A&M University on Legal Considerations for the Paycheck Protection Program (PPP)

- Ensure your business properly qualifies: After the second injection into PPP, the SBA has been approved to fund $670 billion in loans. These loans are generally available for businesses with 500 or fewer employees, but there are other scenarios under which a small business can qualify. This includes companies with a net worth of less than $15 million or a net income of less than $5 million. While companies may meet these thresholds, you must also consider affiliation rules, which can become complex. If you are affiliated with another business, you must also calculate the number of employees and the financial aspects of that company and whether you qualify for a PPP loan is considered in the aggregate of your affiliates.

- Consider key borrower certifications: PPP applications require applicants to certify three key items that Newman stresses business should pay careful attention to including, "Current economic uncertainty makes this loan request necessary to support ongoing operations of the Applicant”; "The Funds will be used to retain workers and maintain payroll or make mortgage payments…” ; and "The Applicant will provide documentations verifying number of employees and payroll costs for the eight-week period following this loan." While the need for these funds may seem vital to business survival, Newman says companies should be certain that the use of PPP funds carefully meets these criteria in order to ensure funds are granted and can be forgiven.

- Be prepared to come under scrutiny: Newman noted that the SBA and Treasury have threatened audits for all PPP loans greater than $2 million and are giving more scrutiny to borrower certifications and funding applications. While their term of scrutiny is not well-defined, Newman says that because of this, businesses should ask themselves if they really need this money as the additional examination may outweigh the benefits of an immediate cash injection in the long run. Newman adds that businesses receiving PPP loans should pay careful attention to documentation and keep meticulous records should the loan come under questioning down the line.

Frank Landreneau, CFO and Director, International Tax Services, PKF of Texas on Tax & Financial Considerations of PPP Loans

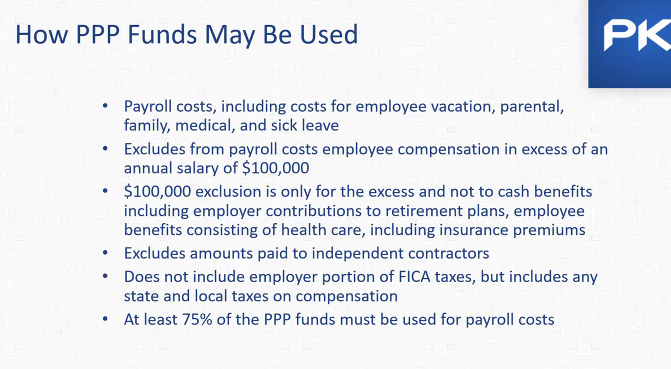

- You got a PPP loan, now what? With businesses focused on quickly paying out loan funds to employees or mortgage costs, many are not necessarily thinking through the accounting and tax implications that come along with the receipt of funds. The first step that should be taken upon receipt of a PPP loan is recording the loan amount for financial accounting and tax purposes until the loan is forgiven and should be set up with a separate account code within your general ledger to provide easy tracking of the funds. While not required, Landreneau recommends obtaining a separate bank account for the loaned funds to aid in tracking. “Retaining documentation to support all payments with PPP funds will also be paramount” when it comes time to complete a business’ taxes or when the loan is being reviewed for forgiveness. Landreneau also provided an overview of how PPP funds may be used.

- Preparing for loan forgiveness: Landreneau further stressed the importance of careful documentation when discussing computation of the loan’s forgiveness. This documentation should include payroll tax fillings reported to the IRS; state income, payroll and unemployment insurance filings; payment receipts; documents verifying payments on covered mortgage obligations, payments on covered leases and payments on covered utility payments; and other documentation the SBA determines necessary. PPP loan forgiveness is available to the extent that funds were spent on qualified expenses during the eight-week period beginning, which starts on the loan funding date. Businesses that received PPP loans can apply for loan forgiveness at completion of the eight-week period and the decision should be received within 60 days of the filing. Landreneau noted that on businesses tax filings, loan forgiveness should be recorded as other income for financial statement purposes and that loan forgiveness is not taxable under the CARES Act. Before concluding, Landreneau added that PPP loans come along with many provisions with tax implications and that businesses should closely consult with the legal and tax advisors on how these provisions interact with one another.

Jeff Sorrells, Senior Human Resource Specialist, PHR, Insperity on Human Resource and Safety Matters of Reopening

- The workplace left 6-8 weeks ago is not the same: While places of work may look the same on the surface, Sorrells stressed that the virus is an invisible hazard that must be carefully considered in the measures taken to keep the workplace clean and employees healthy. He added that there are new chemical hazards entering the workplace in order protect from the virus. With those new measures, employers and employees are both going to need training on how to maintain new cleaning measures and protocols. “Employee compliance in adhering to cleaning and safety measures are going to be key.” Sorrells said. Sorrells recommends employers conduct a hazard assessment of their workplace, provide thorough worker training, and refer to CDC guidelines for cleaning and disinfecting the workplace as they begin their plans for bringing workers back.

- Employee relations matter more than ever: Sorrells went through several scenarios regarding how employers can address specific issues that may arise as employees return to the workplace. He stressed that first and foremost, employees should feel safe and comfortable about their return to work. He added that it is important for procedures employers are taking to ensure workplace health and safety to be overly communicated to employees, including cleaning and disinfesting measures and what their company is expecting of the employee in terms of safety compliance, such as wearing a masks and use of common areas. While planning your communication strategy for your employees, companies should reiterate that reopening will be an ongoing process that will happen in phases, and expectations of employees through each of these phases should be explained in detail and communicated regularly.

Visit the Partnership's Work Safe page for guidelines and resources to support businesses across the greater Houston region as they reopen and remain focused on the steps needed to resume work safely, sustainably and successfully. Read the Reopen Houston, a resource guide containing industry-specific best practices to aid businesses in reopening or expanded their operation and guidance for employers.

The Houston Report

The Houston Report