The Partnership sends updates for the most important economic indicators each month. If you would like to opt-in to receive these updates, please click here.

Estimated Reading Time: 2 minutes.

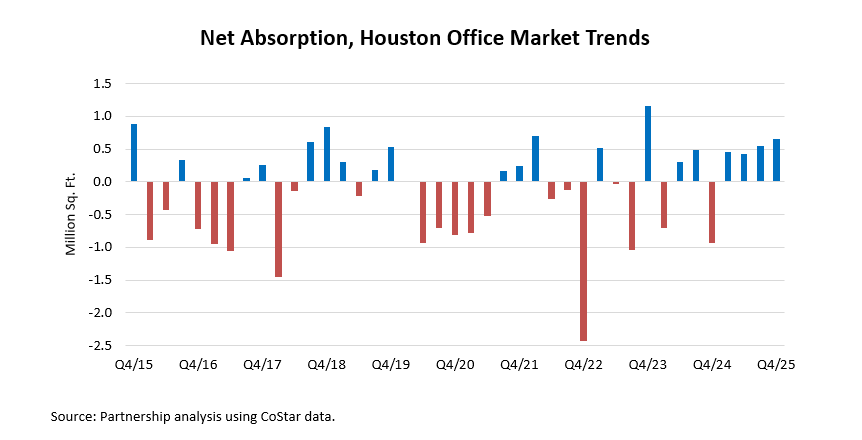

The Houston office market recorded 659,187 square feet of net absorption in Q4/25, marking the fourth consecutive quarter of positive demand and continuing the rebound from the negative 939,207 square feet recorded in Q4/24. This recent improvement follows an extended period of volatility. For the full year, the market posted approximately 2.1 million square feet of positive absorption in ‘25, a notable turnaround from negative 855,509 square feet in ‘24. Despite this momentum, longer-term trends remain uneven. Houston has recorded negative absorption in three of the past five years and seven of the last ten, indicating that periods of space contraction have continued to outweigh expansion over time.

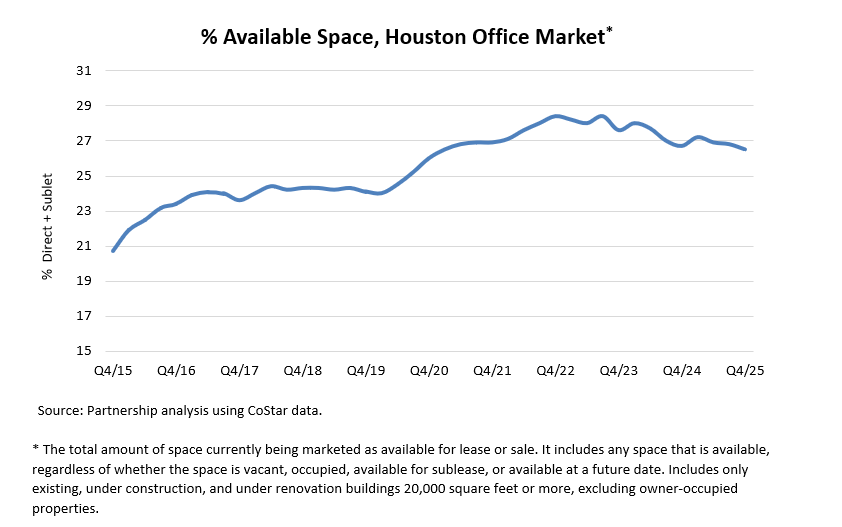

Since Q4/15, quarterly net absorption has averaged negative 134,086 square feet, highlighting the structural challenges the Houston office market has faced in sustaining consistent demand. The availability rate, which includes vacant, soon-to-be-vacant, and sublease space, peaked at 28.4 percent in Q4/22 before easing to 26.5 percent in Q4/25. Prolonged periods of contraction over the past decade have contributed to the elevated level of available space that remains in the market.

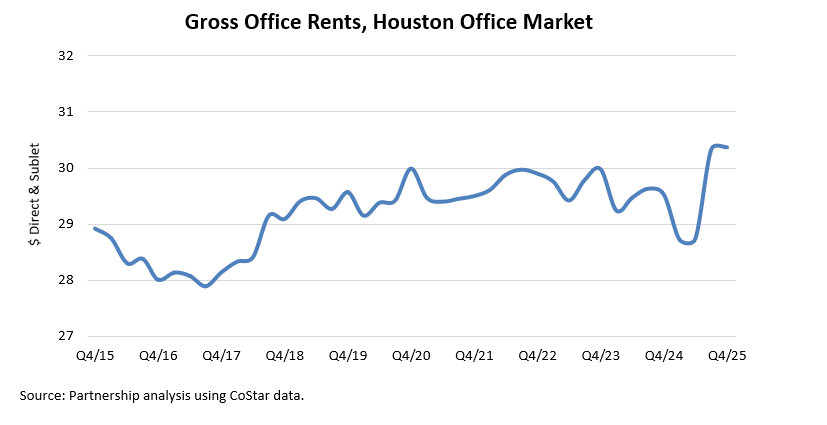

At the same time, the Houston office market recorded a continued increase in asking rents. Average gross rents rose to $30.37 per square foot in Q4/25, up approximately three percent from $29.46 per square foot in Q4/24, pushing overall asking rents above the $30 threshold for the second time since before the COVID-19 pandemic. This upward movement reflects landlord confidence in top-tier assets and the ongoing flight-to-quality trend, as tenants remain focused on well-located, higher-quality Class A space.

Negative absorption over the past decade has added a substantial amount of space to the Houston office market. By class, available space totals approximately 39.7 million square feet in Class A buildings, 26.3 million square feet in Class B properties, and 1.8 million square feet in Class C assets. Given current availability levels, upcoming lease expirations, and historical absorption patterns, the market is likely to face continued challenges in reducing vacancy to healthier levels. While overall availability edged down to 26.5 percent in Q4/25, conditions remain far from pre-‘15 norms, when availability rates were below 20 percent. Sustained positive absorption and the emergence of new demand drivers will be necessary to meaningfully reduce vacancy levels over time.

Negative net absorption has continued to pressure landlords, limiting their ability to raise rents consistently. While nominal rents increased in ‘25, inflation-adjusted rent growth remains negative, underscoring the market’s ongoing difficulty in achieving meaningful real rent gains despite recent nominal highs.

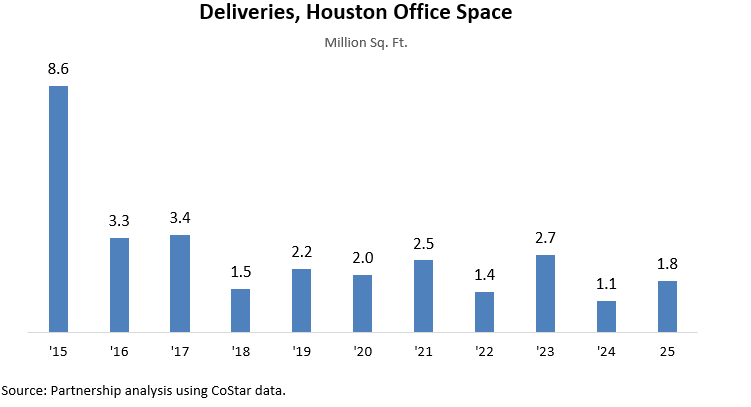

Office construction remains constrained by elevated vacancy and lingering oversupply, resulting in a significantly thinned development pipeline in recent years. Office deliveries totaled approximately 1.1 million square feet in ‘24, followed by 1.8 million square feet in ‘25. As of Q4/25, roughly 1.2 million square feet of office space was under construction, representing about 0.5 percent of Houston’s total office inventory of 253.4 million square feet and well below the 10-year average of 3.0 million square feet. Medical office projects accounted for 260,485 square feet of the construction pipeline in Q4/25. While medical office represented nearly 60 percent of office construction activity in late ‘24, its share has since moderated to approximately 27 percent as overall development activity has remained subdued.

When leases come up for renewal, tenants are scaling back their space needs or relocating to newer buildings and those with better amenities. At the end of Q4/25, the vacancy rate for newer buildings completed in the past 15 years averaged 15.3 percent compared to 28.1 percent in older, vintage buildings completed before ‘09.