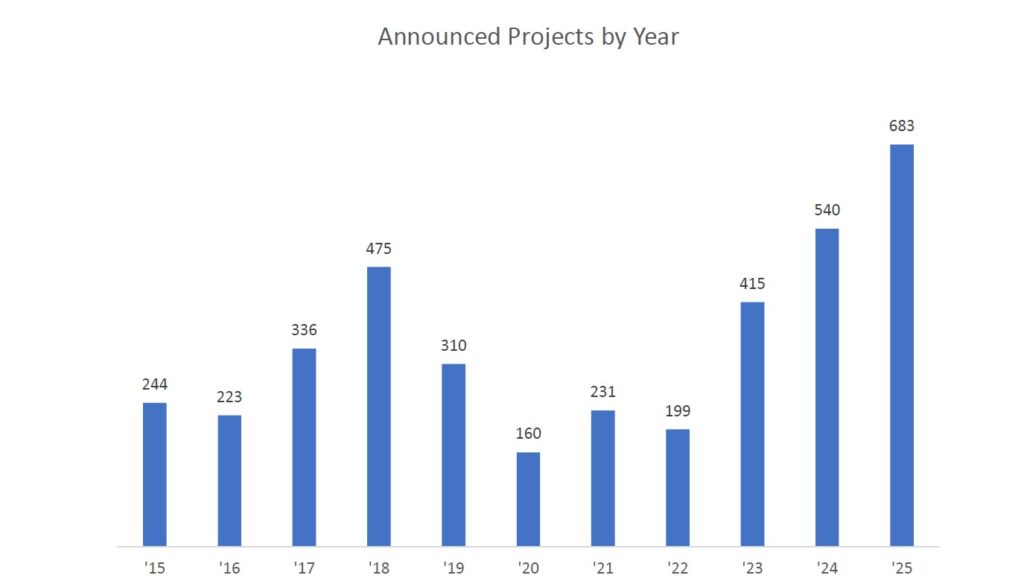

The Greater Houston Partnership identified a total of 683 new business announcements (NBA) in the Houston area in ’25, a 26 percent increase over the 540 identified in ‘24.

These announcements represent companies that are either establishing new operations in the region, relocating to the region, or expanding their existing operations in the area.

To qualify as a “new business announcement,” the project must disclose at least one of the following: jobs created, capital investment, and/or footage of office or industrial space leased. Only a small fraction of the new business announcements disclose more than one of these values, however. As a result, the Partnership’s analysis of capital investment, employment, and square footage represents a low-ball estimate for new business activity. Of the 683 announcements, 35 provided employment information totaling 14,834 new jobs, 42 on the capital investment totaling $10.5 billion, and 665 on space occupied totaling 602.8 million square feet.

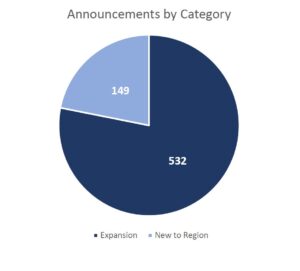

CATEGORY

The bulk of activity involved the expansion of existing Houston-area operations, which totaled 532 projects in ‘25, a 40 percent increase over the 379 announced in ‘24. These are companies that already have establishments in the Houston area and have either expanded their real estate footprint in the area or have added a significant number of new jobs.

A total of 149 businesses established new facilities in the Houston area in ‘25, a decrease of 6 percent from 158 companies new to the region in ‘24.

To qualify as a “new business announcement,” the project must disclose at least one of the following values: number of created jobs, amount of capital invested, and/or footage of office or industrial space leased. Only a small portion of the new business announcements disclose more than one of these values, however. As a result, the Partnership’s analysis of capital investment, employment, and square footage represents a low-ball estimate for new business activity.

YEAR-OVER-YEAR

‘25 logged 683 announcements, a 26 percent increase over ‘24 when 540 projects were announced.

‘25 New Business Announcements Summary:

- 683 announced projects

- 35 projects reported 14,834 new jobs

- 42 projects reported $10.5 billion estimated capital expenditures

- 665 projects reported 44.5 million estimated commercial square footage

‘24 New Business Announcements Summary:

- 540 announced projects

- 46 projects reported 6,760 new jobs

- 45 projects reported $10.7 billion estimated capital expenditures

- 499 projects reported 36.3 million estimated commercial square footage

Over the past five years, Houston has experienced a significant increase in project activity. Project announcements rose from 160 in 2020 to 683 in ‘25—representing a 327 percent increase—making ‘25 the strongest year of the past decade. Prior to ‘25, new business activity peaked in ‘24 with 540 announced projects. Activity declined to 310 projects in 2019, reflecting economic uncertainty driven by trade tensions and slowing global growth, before falling further to 160 in 2020 as the COVID-19 pandemic disrupted the economy. Momentum began to recover in 2021 with 231 projects, followed by a modest pullback to 199 in 2022.

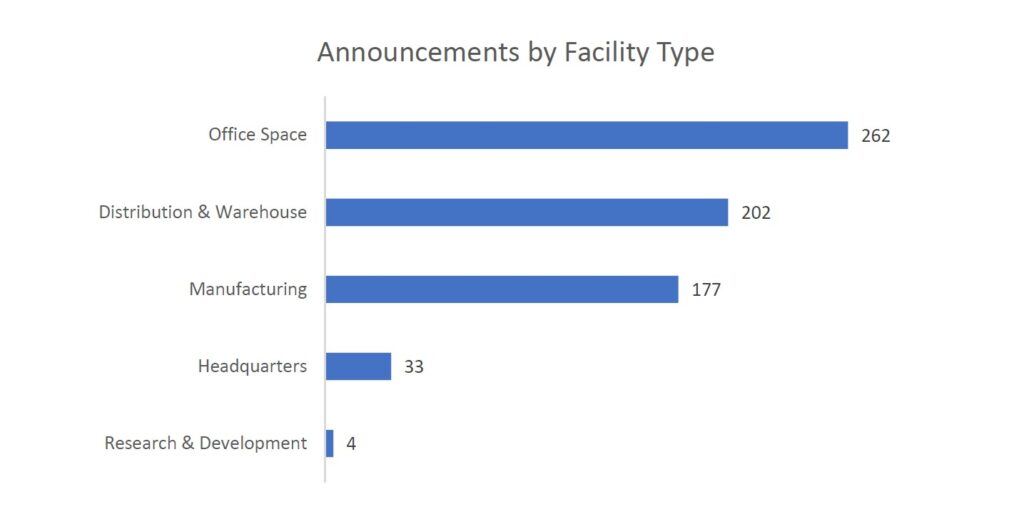

ANNOUNCEMENTS BY FACILITY TYPE

The project announcements in ‘25 fall into five categories: distribution warehouse, headquarters, manufacturing, office, and research and development.

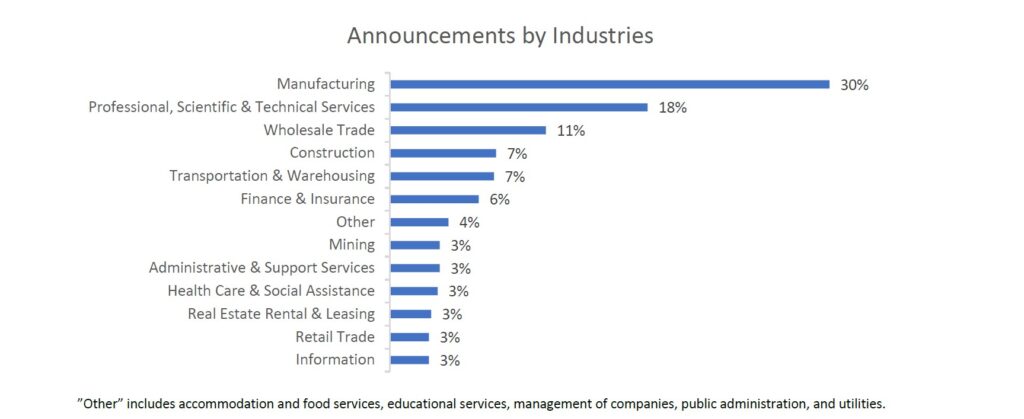

ANNOUNCEMENTS BY INDUSTRY

A third (30 percent) of the announcements in ‘25 involve companies engaged in manufacturing. This includes various industries from concrete manufacturing to solar panel manufacturing. Notable companies include Eli Lilly, Foxconn, and Tesla.

Professional, Scientific, and Technical Services ranked second and accounts for 18 percent of all announcements. This sector primarily comprises companies specializing in technical consulting, engineering, and scientific research & development. Notable companies making announcements in this sector include Navarro and NAES Corp.

PARTNERSHIP WINS

The Partnership played a key role in 23 of the new business announcements in ‘25. The Partnership’s support included services such as potential site selection, possible incentives for establishing a facility in the area, and market research. These Partnership supported projects collectively generated more than 6,500 new jobs, attracted more than $9.6 billion in capital investment, and represented 10 U.S.-based companies and 13 international companies. These wins contributed to over 23,000 indirect jobs and an economic impact of more than $27 billion to the Houston area.

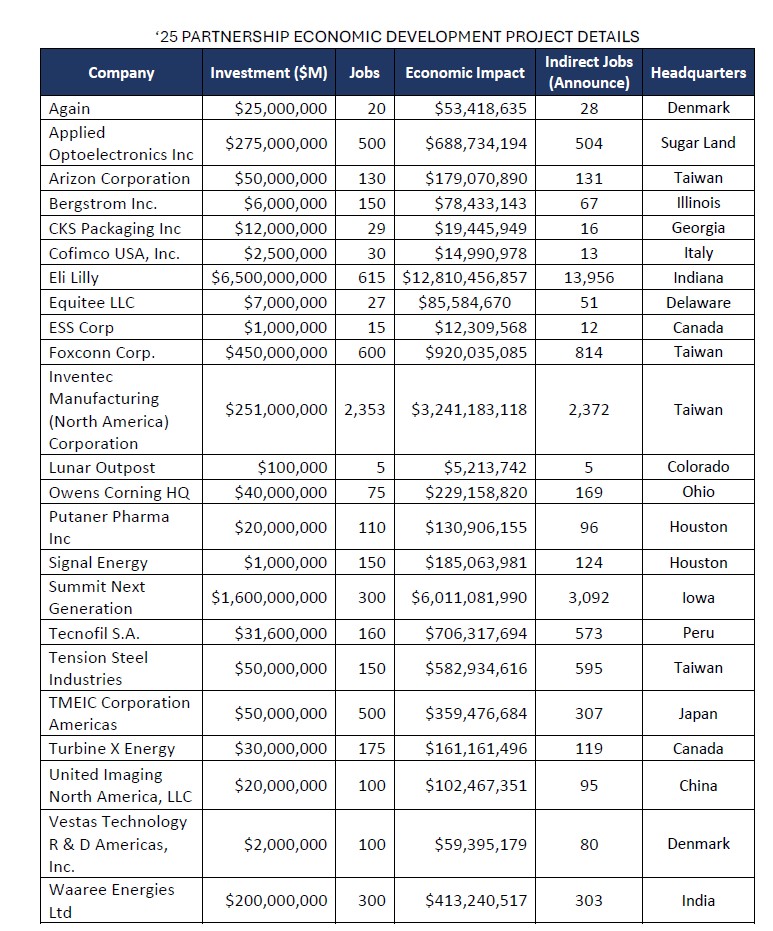

2025 PARTNERSHIP ECONOMIC DEVELOPMENT PROJECT DETAILS

Details on selected Partnership projects:

- Again is a Denmark-based carbon capture & clean chemical manufacturing company.

- Applied Optoelectronics, Inc., is a Sugar Land-based electronics manufacturer looking to expand its footprint by onshoring part of its international production line.

- Arizon Corp. is a Taiwan-based company opening a manufacturing facility in the Houston area.

- Bergstrom Inc. is an Illinois-based company that aims to re-shore its manufacturing facility for sheet metal components.

- CKS Packaging Inc. is a rigid plastics packaging manufacturing company seeking to expand its US operations.

- Cofimco USA, Inc. is based in Italy and expanding its fan manufacturing presence in Houston.

- Eli Lilly is an Indiana-based pharmaceutical manufacturing company investing in a $6.5 billion facility to manufacture Orforglipron, its first oral obesity pill, and other small molecule medicines, creating 4,000 construction jobs and 615 permanent jobs.

- ESS Corp. is a Canadian-based company expanding its pressure vessel manufacturing operations in the Gulf Coast.

- Equi-Tee LLC is a Delaware-based company opening a new polymer production facility for high-performance waxes.

- Foxconn Corp. is based in Taiwan and manufactures electronics for companies such as Apple. It is expanding production lines in North Houston to build an AI server.

- Inventec Manufacturing (North America) Corporation is a Taiwanese company for advanced technology manufacturing of AI servers/laptops.

- Lunar Outpost is a Colorado-based company building space satellites for NASA.

- Owens Corning is an Ohio-based building materials manufacturer expanding its Houston presence.

- Putaner Pharma Inc. is Houston-based and focuses on the research, development, and production of high-quality dietary supplements, pet nutrition products, and cosmetics.

- Signal Energy is expanding its office presence and moving its headquarters to the Houston area, which was previously located in Tennessee.

- Summit Next Generation, an Iowa-based company, is partnering with Honeywell on a new sustainable aviation fuel project on the Gulf Coast.

- Tecnofil S.A., a Peruvian company, is installing a copper bar production facility in Houston to serve the US market.

- Tension Steel Pipe USA is a Taiwanese company building an API oil pipe factory in New Caney on approximately 35 acres of land.

- TMEIC Corporation Americas is a Japanese company breaking ground on its third manufacturing facility in the region.

- TurbineX Energy is a Canada-based company establishing a new U.S. facility in the Houston area.

- United Imaging is a Chinese medical device company looking to expand its Houston facility.

- Vestas Technology R&D Americas, Inc. is a Denmark-based, global wind energy company looking to relocate its U.S. headquarters from Oregon.

- Waaree Energies Ltd., an India-based solar panel manufacturing company, is expanding its existing facility in Brookshire, TX.

Methodology

Our methodology involves compiling information from a variety of sources to create our New Business Announcements (NBAs) database. Methods include, but are not limited to, scraping headlines, monitoring alerts, and tapping into several databases. We also include Partnership-assisted projects from our Economic Development Division. Generally, NBAs are projects that meet the qualifying criteria for new and/or expanded corporate real estate facilities, such as having new construction or renovation and meeting one or more of the following criteria: creating 20 or more new jobs, having 5,000 or more square footage, or having an investment of $1 million or more. Retail, educational, government, and other non-commercial facilities do not qualify, but projects creating a headquarters, data center, distribution warehouse, call center, or research and development facility will count.

Prepared by Greater Houston Partnership Research

Margaret Barrientos

Senior Analyst, Research

[email protected]