The Partnership sends updates for the most important economic indicators each month. If you would like to opt-in to receive these updates, please click here.

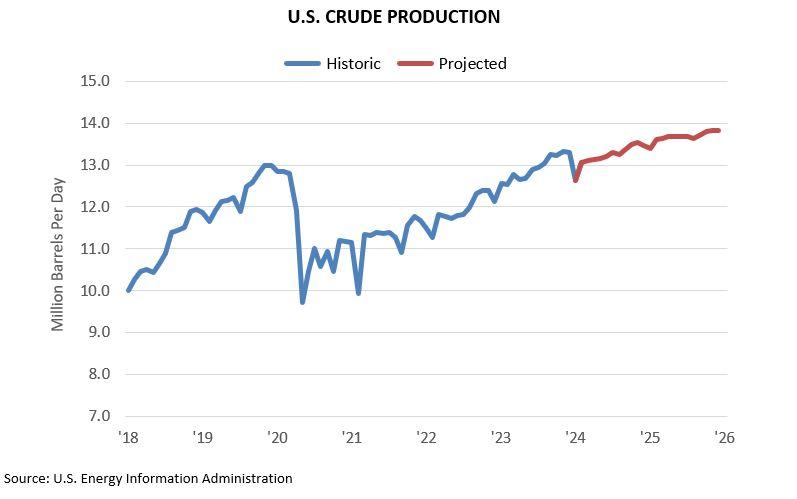

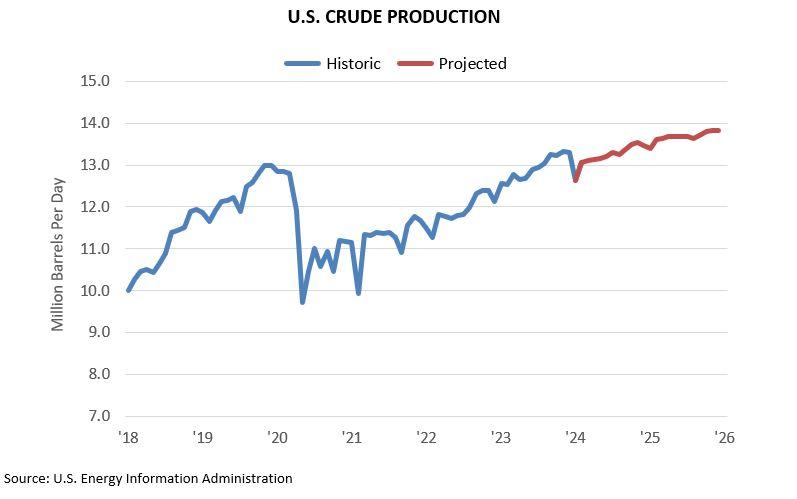

U.S. CRUDE PRODUCTION

The Energy Information Administration (EIA) estimates U.S. crude production hit 13.1 million barrels per day (b/d) in February. EIA expects production to growth through the end of the year, hitting 13.5 million barrels in December ’24, which would be a new record. That’s up from the previous record of 13.3 million b/d in December ’23. Based on projected demand and market conditions, EIA expects U.S.to top 13.8 million barrels in December ’25.

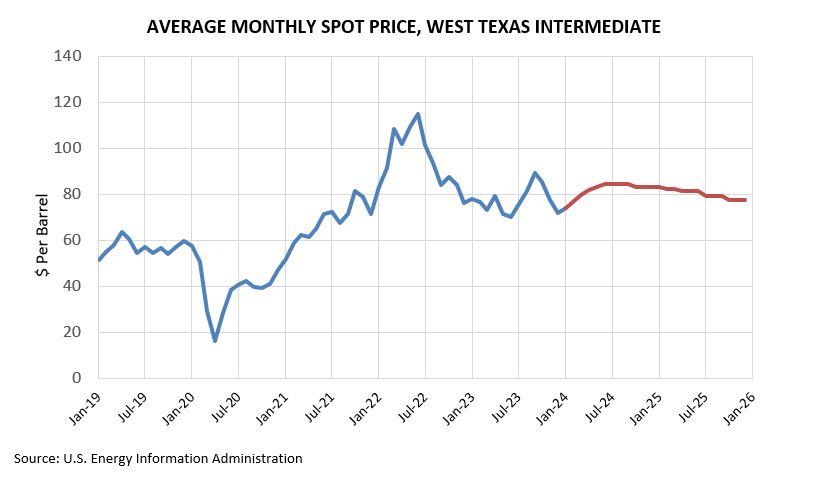

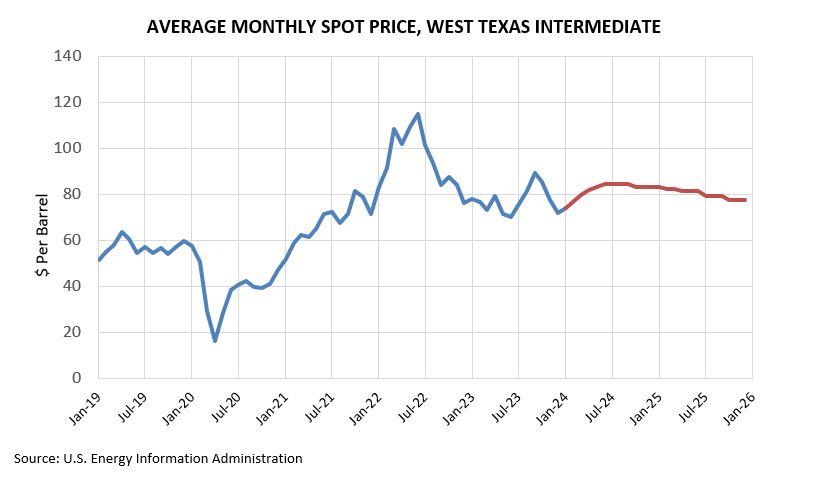

CRUDE PRICES

Brent, the global crude benchmark, averaged $83.48 in February, up marginally from $82.59 in February ’23. West Texas Intermediate, the U.S. benchmark for light sweet crude, averaged $77.25 in February, up nominally from $76.83 in February ’23. EIA forecasts Brent to average $87.00 per barrel this year and $84.80 in ’25. The agency forecasts WTI to average $82.50 this year and $80.30 in ’25.

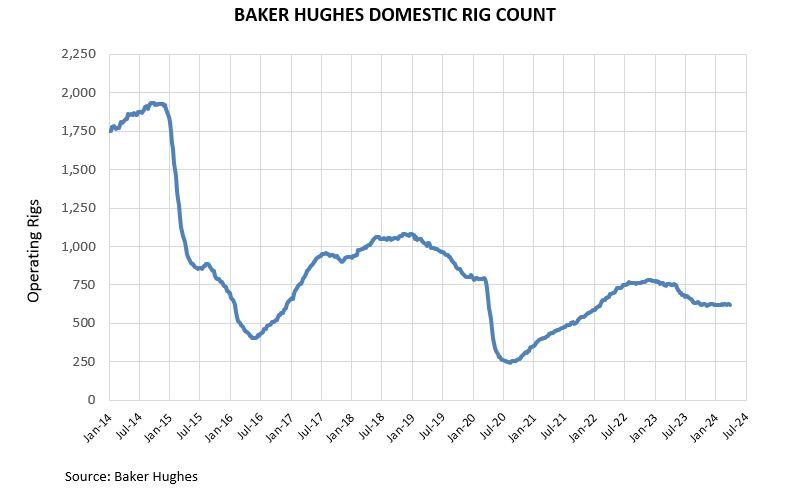

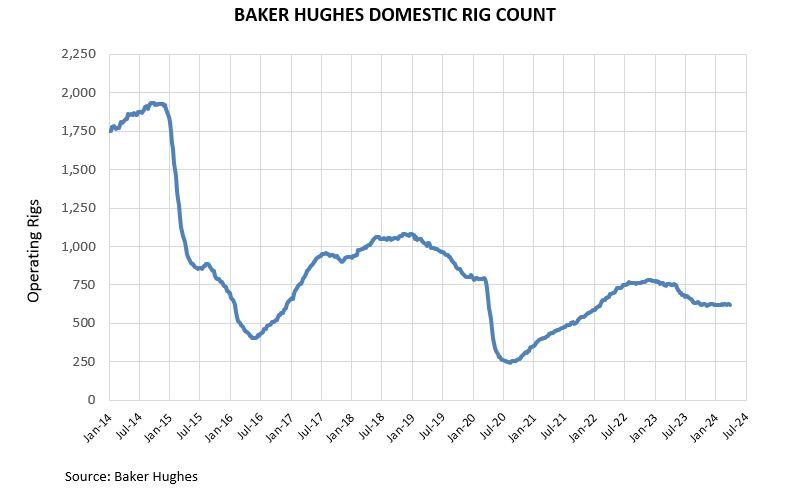

DOMESTIC RIG COUNT

The Baker Hughes domestic rig count averaged 622 in February, down 758 from the same month in ’23. As noted before, more efficient drilling techniques, longer laterals (the horizontal portion of a well) and improved well productivity have helped the industry increase output. EIA estimates that in February ’24, average initial production per rig working in the Permian Basin was up 24.4 percent compared to February ’23 and 89.4 percent compared to February five years ago.

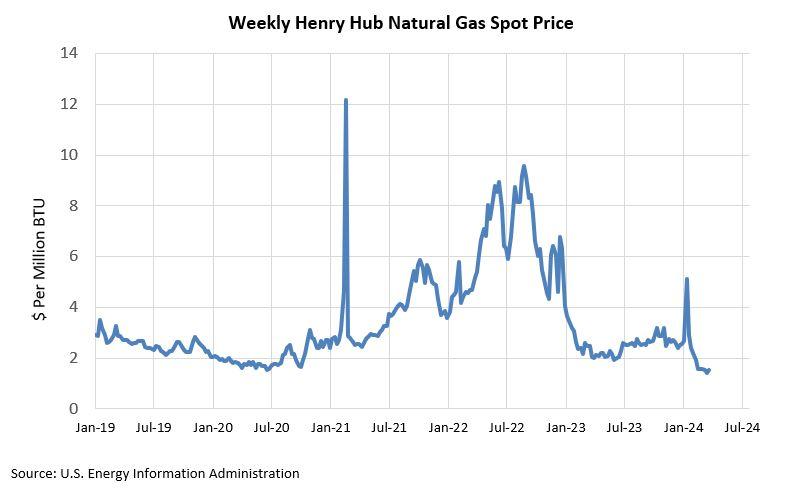

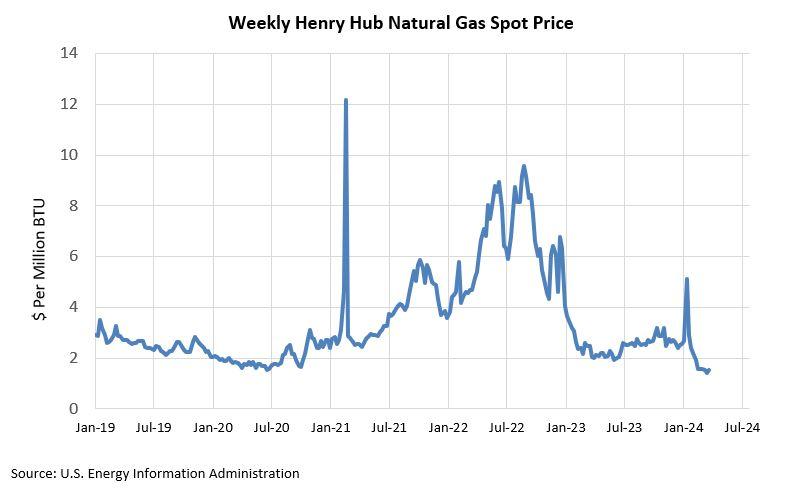

NATURAL GAS

The Henry Hub spot price averaged $1.72/MMBtu in February. Low prices were partially driven by reduced natural gas consumption in the residential and commercial sectors this winter. EIA expects the Henry Hub spot price to remain below $2.00 per million British thermal units (MMBtu) in 2Q/24 as the winter heating season ends with natural gas inventories 37 percent above the five-year average.

Prepared by Greater Houston Partnership Research Department

Patrick Jankowski, CERP

Chief Economist

Senior Vice President, Research

[email protected]

Leta Wauson

Director, Research

[email protected]