Key January Takeaways

Here are the facts to know about the Houston region this month

1 January Takeaway #1

The Partnership’s forecast calls for the region to add 57,600 in ’24.

2 January Takeaway #2

When December employment data is finally released, the region will have created 74,000 to 84,000 jobs in ’23.

3 January Takeaway #3

Metro Houston GDP hit $633.2 billion in ’22.

2024 Houston Forecast

Growth will be slower in ’24 than ’23. Higher interest rates, ongoing labor shortages, reductions in government spending, tighter lending standards, and turmoil in commercial real estate will weigh on the economy. If the U.S. slows, so will Houston.

Editor’s Note: The following summarizes the Partnership’s ’24 employment forecast released December 7, 2023. The summary includes several economic indicators that have been updated since the forecast was first released. The updates did not change the outlook. The full forecast can be found at www.houston.org/economy.

Growth will be slower in ’24 than ’23. Higher interest rates, ongoing labor shortages, reductions in government spending, tighter lending standards, and turmoil in commercial real estate will weigh on the economy. If the U.S. slows, so will Houston.

Signs of a local slowdown have already emerged:

- Through November of ’23, metro Houston created 57,300 private sector jobs. That’s down from 121,100 over the comparable period in ’22.

- The Baker Hughes U.S. rig count slipped to 622 the last week of December ’23, down from 779 the same week in ’22.

- Adjusted for inflation, sales tax collections in the region’s twelve most populous cities were up 2.0 percent through October. At the same time in ’22, they were up 5.1 percent.

- Construction activity peaked in ’22 and has trended down since. City of Houston building permits through October are down 8.9 percent compared to ’22, after adjusting for inflation. Initial reports from Dodge Data & Analytics suggest activity outside the city is down by as much as 20 percent.

A recession might still occur, but it would be triggered by events beyond the Fed’s control, like a global trade war, an extreme weather event, direct conflict between China and Taiwan, a prolonged U.S. government shutdown, an oil price spike, the Israel-Hamas war spreading to other countries, and the Ukraine-Russia war spiraling into a global conflict. The Partnership assigns no probabilities to these events but acknowledges any one of them could dramatically alter this forecast.

Three factors will temper growth in ’24—a tight labor market, persistent high interest rates, and turmoil in commercial real estate.

Tight Labor Market

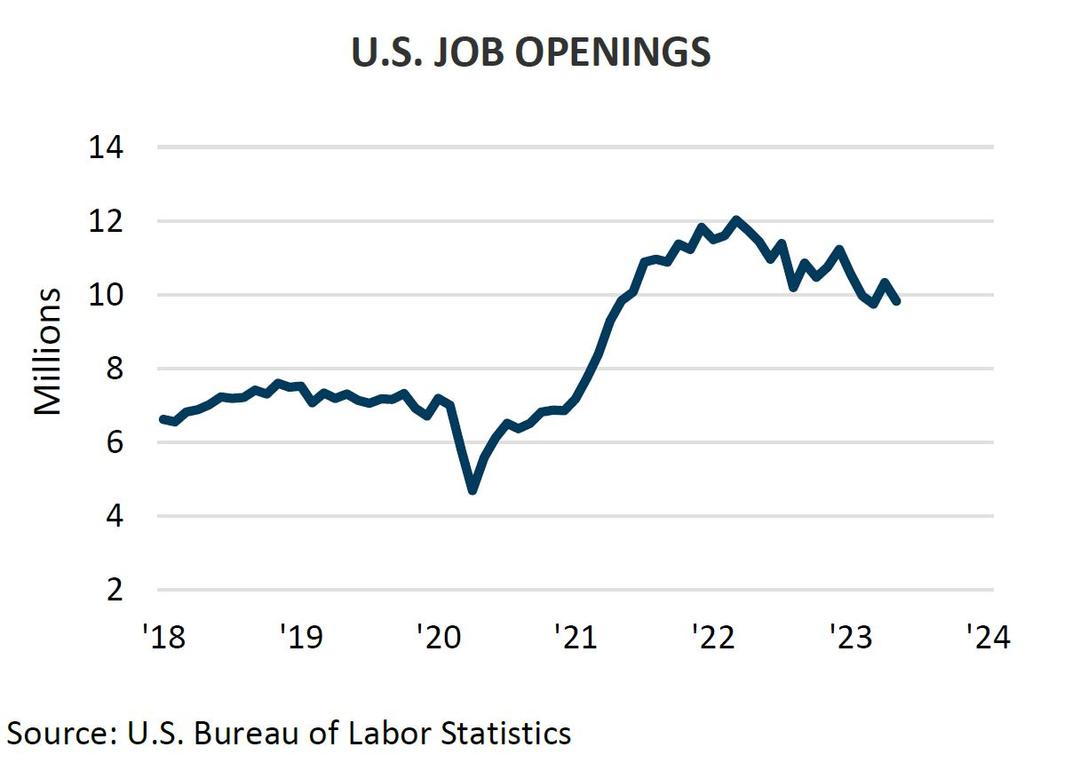

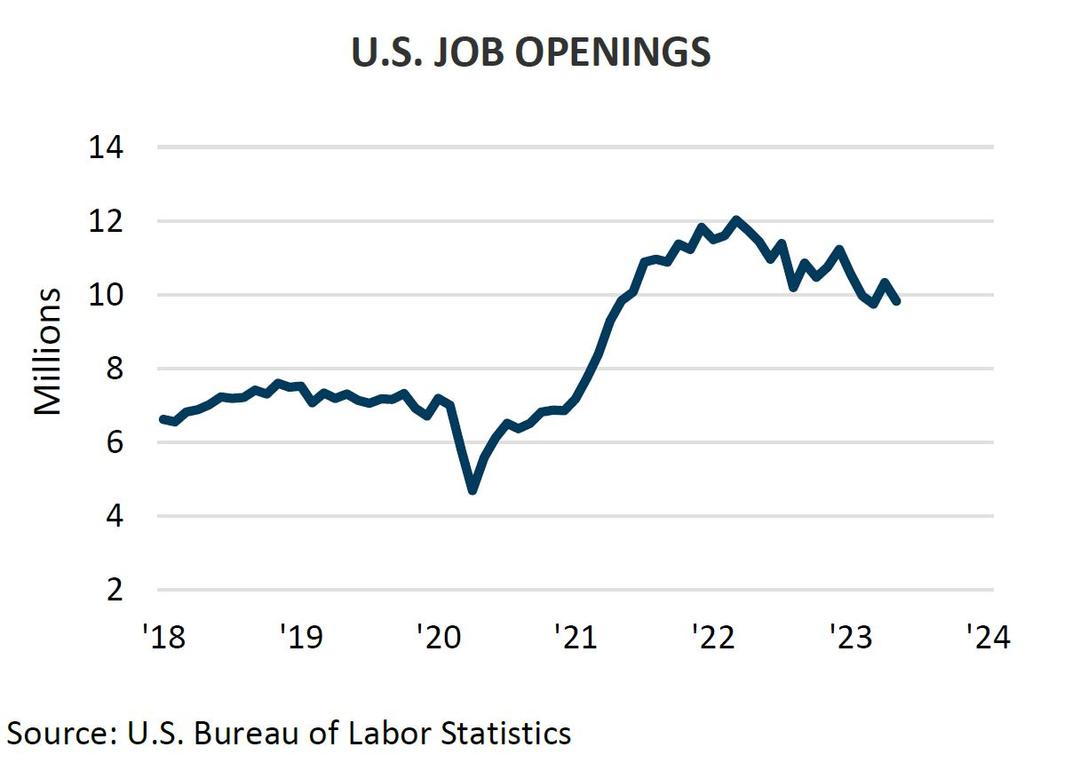

The U.S. labor force will continue to grow but not fast enough to keep pace with the demand for workers. The Bureau of Labor Statistics estimates 3.7 million Americans joined the labor force between November ’22 and November ’23. In November, there were 8.8 million job openings.

Employers always have open positions. Some workers quit, others retire, or the firm needs the extra hands to expand operations. The current level of openings, however, is 37 percent above the average number of openings in the five years prior to the pandemic. Unless more workers come off the sidelines or the U.S. allows more legal immigration, chronic worker shortages will prevail.

Interest Rates and Inflation

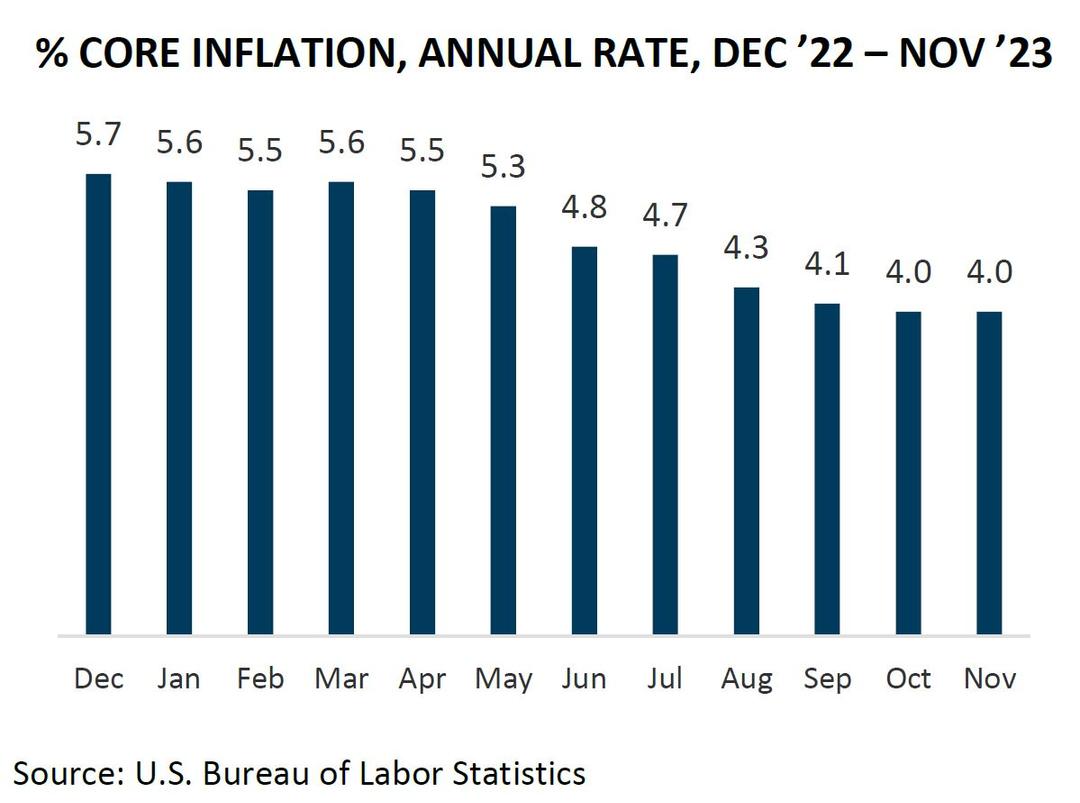

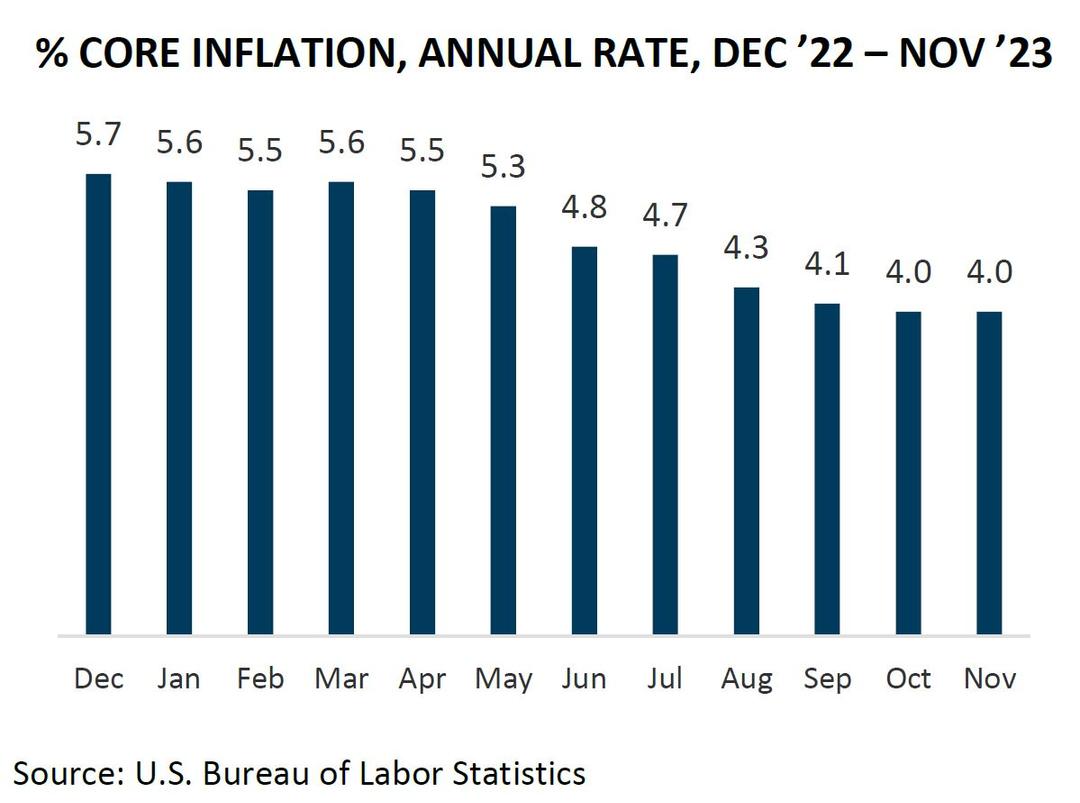

The annual inflation rate was 3.1 percent in November. The core rate, which excludes volatile food and energy, was 4.0 percent. Most forecasts call for core inflation to track 2.5 percent or better for most of ’24. As long as the in¬flation rate tracks above the Fed’s preferred 2.0 percent target, the bank is unlikely to lower interest rates despite what the financial markets suggest.

Commercial Real Estate Woes

Turmoil in commercial real estate will also impede growth. A recent study by Newmark Group, a real estate firm, determined that $1.2 trillion of U.S. commercial real estate debt is highly leveraged while property values are falling. Office buildings account for more than half of the at-risk debt set to mature within the next two years.

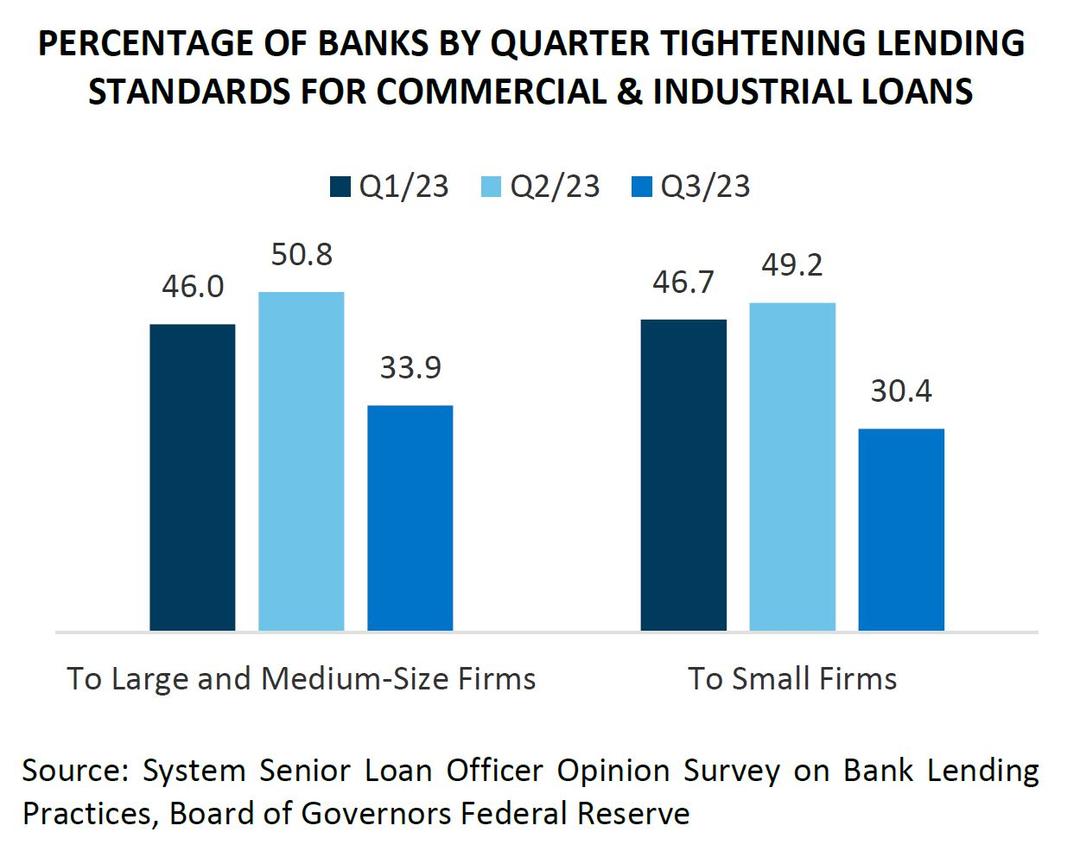

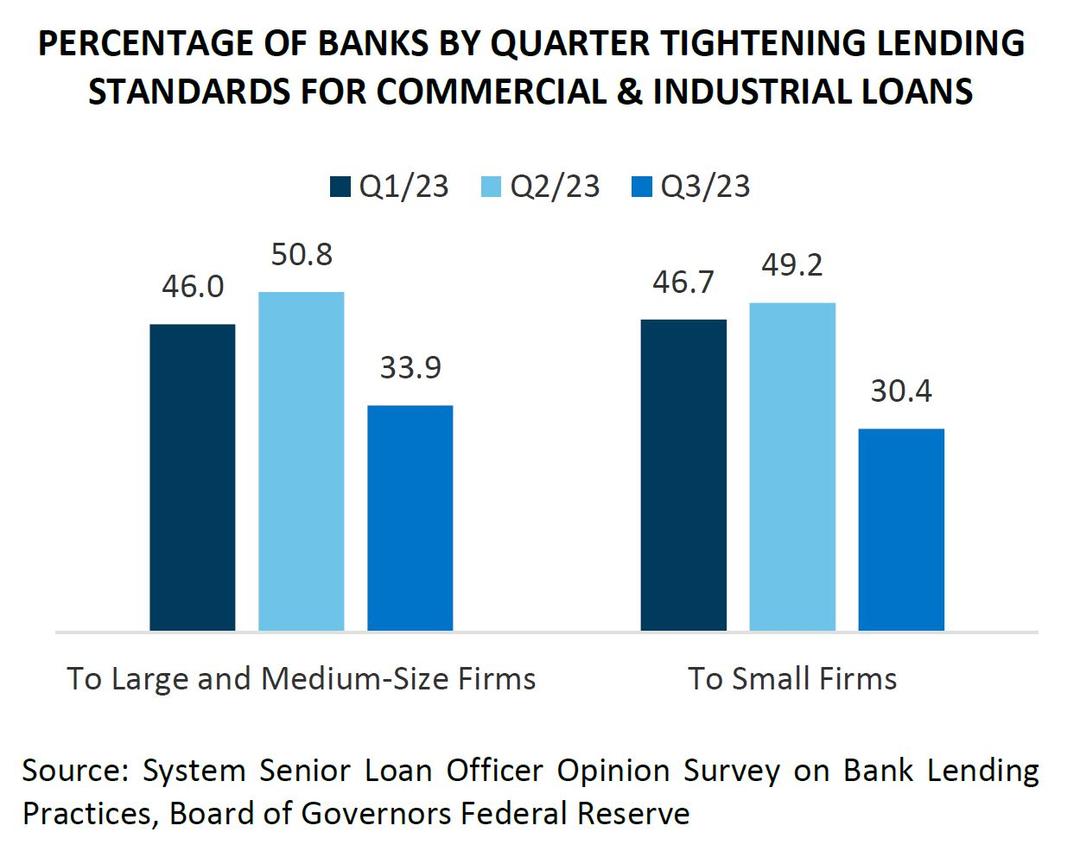

Banks are setting aside reserves to cover potential losses. They have also reduced lending. Half of all respondents to the Fed’s Senior Loan Officer Opinion Survey indicated they tightened lending standards to small, medium-sized, and large firms in Q2/23 and a third did so in Q3/23.

Pension funds, private equity groups, and insurance companies have also become more careful with their lending and acquisitions. Across the board, access to capital will be limited and impede growth.

To continue reading, download this report.