Key Takeaways

Here are the facts to know about the Houston region this month

Takeaway #1

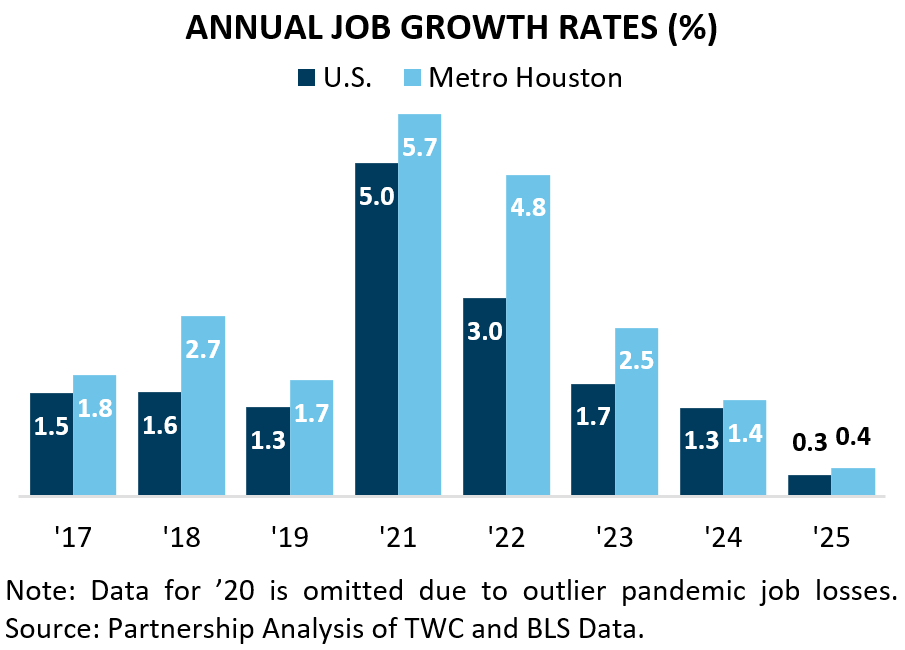

Even as the labor market cooled, Houston's 0.4 percent rate of job growth came in modestly higher than the national 0.3 percent, marking the 8th consecutive year where Houston outperformed the rest of the nation.

Takeaway #2

While tariffs pulled down the region's overall trade value by 4.7 percent, Port Houston proved resilient and is on track for a record year in container traffic.

Takeaway #3

Commercial real estate reflects a market in transition, with office adjusting to prolonged oversupply and selective tenant demand, while industrial remains supported by expanding activity and population growth.

LOOKING BACK AT ’25

Economic data for the final months of ’25 continue to trickle in. With each report, a clearer picture of the previous year emerges.

- Job growth cooled nationwide. Houston still added jobs at a faster pace than the rest of the country, although its momentum eased from recent years.

- Even with slower job growth, unemployment stayed low—consistent with the national “low-hire, low-fire” environment.

- The Purchasing Manager’s Index signaled continued economic growth, led by non-manufacturing activity.

- Inflation remained above the Federal Reserve’s target, but well below the highs of recent years.

- Port Houston remained on track for a record year in container traffic, even as tariffs pulled down the region’s overall trade in dollar terms.

- Consumers kept spending on big-ticket items, with vehicle sales setting a new high and home sales rising.

- Construction contracts stayed solid, with strength in commercial, industrial, and infrastructure projects offsetting softer residential activity.

Employment

Metro Houston created 14,800 jobs in ‘25. That represents a 0.4 percent job growth rate, which falls below the 1.5 percent average pace of the past decade. The slower pace reflects a broader national slowdown in hiring, which tempered job growth across the United States. Even so, Houston outpaced the rest of the nation for an eighth straight year, with the region’s 0.4 percent job growth rate surpassing the national 0.3 percent. That relative strength speaks to Houston’s solid fundamentals, including its diversified industrial base, large and growing population, and key role in global energy.

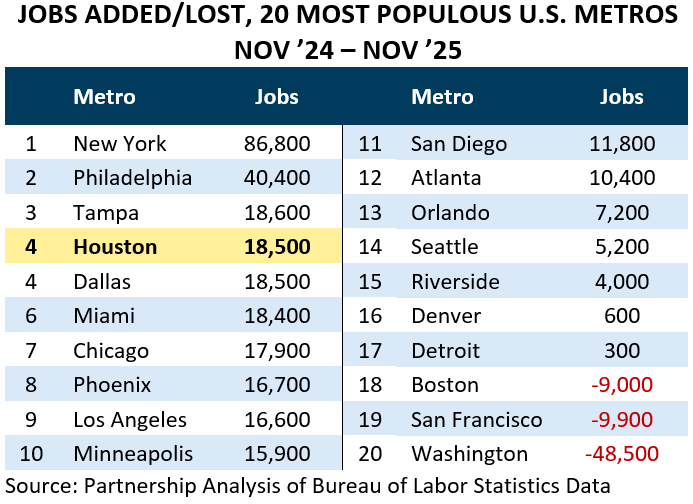

December data are not yet available for a full calendar year comparison with other major metros, but the 12-month picture through November shows Houston outperforming most of its peers. Metro Houston added 18,500 jobs over that span, ranking fourth among the top 20 metros and tied with Dallas. Only New York, Philadelphia, and Tampa posted larger gains. By contrast, Boston and San Francisco each shed nearly 10,000 jobs, and Washington D.C. lost almost 50,000 as federal workforce reductions hit the region especially hard.

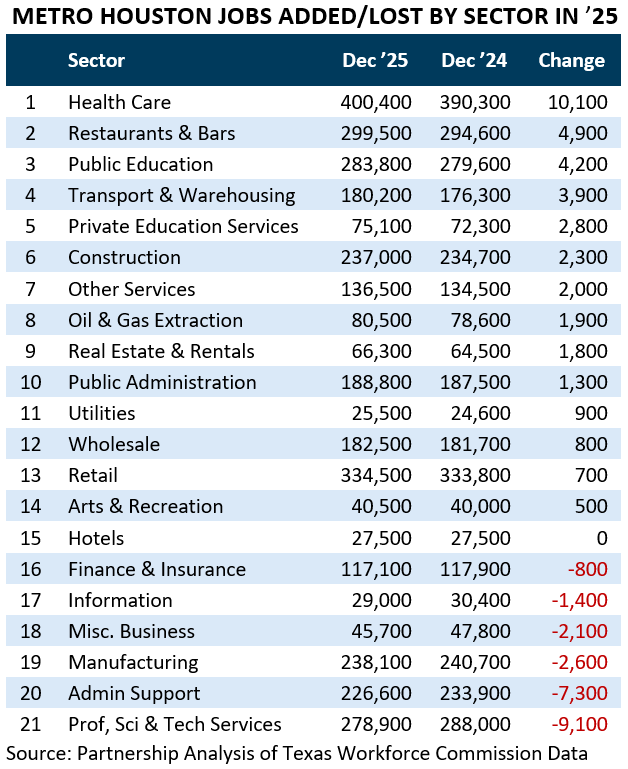

Fourteen of Houston’s 21 major sectors added jobs in ’25. The biggest gains came in health care, restaurants and bars, and public education, followed by solid growth in transportation and warehousing, private education, and construction. These industries, which largely serve the needs of local residents, continued to benefit from a growing population and steady consumer demand.

Six sectors lost jobs, with declines concentrated in office-heavy industries, especially professional, scientific, and technical services, and administrative support. Because these sectors largely serve other businesses, the pullback reflects softer client demand and tighter discretionary spending. Some share of that restraint stems from upstream oil companies tightening budgets as lower energy prices in ’25 compressed margins, prompting firms to scale back nonessential spending on services, consulting, and back-office support.

The Partnership expects a partial rebound in ’26, with job growth accelerating from last year’s pace even as it remains below long-run norms. The national headwinds that cooled hiring in ’25 are unlikely to lift quickly, so job gains should remain muted in the first half of the year. Even so, momentum could build as the year unfolds, setting the stage for a stronger second half.

The Partnership’s forecast calls for Metro Houston to add 30,900 jobs in ’26, more than double the 14,800 added in ’25. The region closed December ’25 just shy of 3.5 million non-farm payroll jobs (3,494,000). The forecast expects Houston to cross that milestone in ’26 and end December at a new record high of 3,522,500 positions.

Note: The geographic area referred to in this publication as “Houston,” "Houston Area” and “Metro Houston” is the ten-county Census designated metropolitan statistical area of Houston-Pasadena-The Woodlands-Sugar Land, TX. The ten counties are: Austin, Brazoria, Chambers, Fort Bend, Galveston, Harris, Liberty, Montgomery, San Jacinto, and Waller.

To continue reading, please download the full report below: